By Matt Barnsley

Imagine being 75 years old. You’ve spent your life being a responsible citizen, working hard, and finally, buying rental properties to see you through your retirement years. You’re proud of what you’ve built and the community you’ve invested in. Nothing fancy. Just something to get you by. Then comes the tax bill for your properties and with it, any chances of making a profit go out the window. In fact, if you hadn’t diversified your nest egg, you’d be $7,000 in the red.

Sound like a nightmare? For Carlos Royal, it’s reality. Before the oil boom in North Dakota, Royal wisely purchased apartment buildings, among other properties. As the town swelled with oil money, property values rose considerably. Taxes went up right alongside the boom. All was fine until the boom went bust after 2013. Renters became scarce and suddenly his income from them dropped 75%.

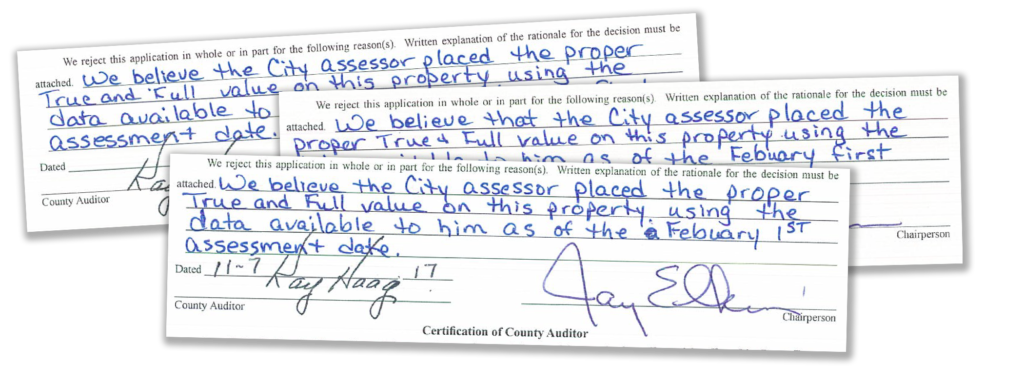

3 of 36: In a stunning display of bureaucratic arrogance, auditor Kay Haag gives the same answer 36 times. In other words, “because we say so.”

You might assume that tax assessments would drop as well. They did, but not nearly enough. For Royal, the most recent assessment on one of his properties came in at $8,760,800.00, a 125% increase in value from 2010, only a few years before the height of the boom. How can a property that’s seven years older, in a town with fewer renters and less income, be worth twice as much as it did when the town was booming? In short, it can’t. Not without there being a fair amount of something suspicious taking place.

Royal isn’t the only person in Dickinson who’s facing unfair tax burdens. There have been dozens of challenges to the assessors’ values. In each case, the property owner has presented evidence of falling incomes and declining values, based on independent appraisals. And in every single case so far, the city has sided with the assessors’ initial value 100% of the time. That simply does not happen. No assessor is 100% accurate. Assessing is an art form, with some variability based on a number of factors. To get 100% accuracy across the board means something else is going on.

Making matters worse, instead of providing the legally required explanation and justification for deciding the way they did, the city sent the EXACT same response to property owners, word for word. In essence, it said ‘your taxes are what they are because we said so’. Wonder why that is? Did the county overextend itself during the boom? Only the commissioners know, and they aren’t talking. Carlos is now forced to take them to court in an attempt to get a fair assessment. He’s even had to start a GoFundMe page to help offset the cost of litigation.

“Because I said so” might be a viable rationale when dealing with a child’s tantrum. It’s a terrible philosophy to use when explaining tax assessments to your constituents. Something in Dickinson stinks and it looks like it’s in city hall.

View 3 of the 36 abatement and rejection forms in their entirety.